Advertiser Disclosure

What's The Most Well-Funded Technology Startup In Your State?

Updated On November 2, 2021

Editorial Note: This content is based solely on the author's opinions and is not provided, approved, endorsed or reviewed by any financial institution or partner.

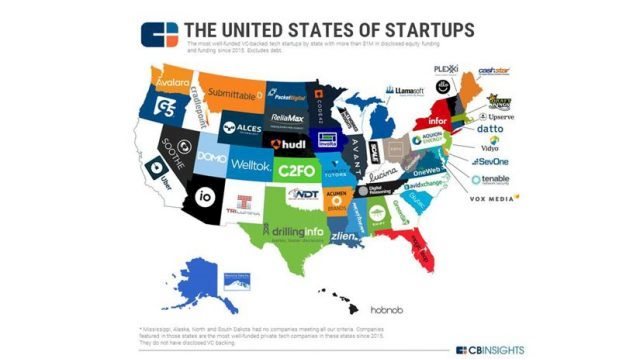

A new map released by CB Insights identifies the most well-funded venture capital-backed technology startup in each state based on disclosed equity funding.

The map includes companies in all 50 states, plus Washington, D.C. Four states – Mississippi, Alaska, North Dakota and South Dakota – did not meet CB Insights’ criteria, so the report includes the most well-funded private technology companies since 2015 in those four states.

Top Picks For Student Loan Refinancing

April 2024

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

View Details

Overview

Details

Disclosures: SoFi | Earnest | NaviRefi | ELFI | Splash Financial | Citizens | Laurel Road | LendKey

Here are some key takeaways:

Most Well-Funded Startup

- California-based Uber is the most well-funded startup on the map with $12.5 billion of funding to date

Top “Unicorns”

- There are nine “unicorns” (companies valued at $1 billion or more) that are also the most well-funded startup in their respective state: Uber (CA), Datto (CT), Magic Leap (FL), GreenSky (GA), Avant (IL), DraftKings (MA), Infor (NY), Domo (UT), and Vox Media (Washington, D.C.).

Companies That Raised At Least $1 Billion in Equity Funding

- There are seven companies on the list that have raised $1 billion or more in disclosed equity funding to date. These companies include, among others, OneWeb (VA), Infor (NY) and IO (AZ).

Companies That Raised At Least $1 Billion In Equity Funding In A Single Funding Round

- Companies that have (at least once) raised $1 billion or more in one round of funding include, among others, Uber (CA), OneWeb (VA) and Infor (NY).

Companies That Raised More Than $100 Million in Equity Funding

- There are 20 companies that have raised $100 million or more in disclosed equity funding to date.

Companies That Raised Less Than $50 Million In Equity Funding

- There are 17 companies that have raised less than $50 million, including Zlien (LA) and Hobnob (Hawaii)

Here is the full list of companies and their accompanying states, including Washington, D.C.:

Every Unicorn In The U.S.

In December, CB Insights also released a map that includes every unicorn in the U.S.. The key takeaways from that map include:

- The U.S. has 98 unicorns.

- Collectively, U.S. unicorns are worth approximately $372 billion.

- Collectively, these companies have raised over $67 billion.

- As of December 2016, there are nine private U.S. companies valued over $10 billion.

- As of December 2016, the three most valuable unicorns in the U.S. are Uber ($68 billion), Airbnb ($30 billion) and Palantir Technologies ($20 billion). These three companies are all located in California.

- California has more unicorns than any other state, followed by New York and Massachusetts.

- Ten other states have at least one company valued at $1 billion or higher.

- The top five most well-funded U.S. unicorns are: Uber, Airbnb, Infor, Snap and Palantir. (Snap has since filed for an initial public offering). All these companies – except Infor – are based in California.

- The newest unicorn in the U.S. is a travel tech company, JetSmarter, which became a unicorn in December 2016.

- The oldest unicorn in the U.S. is a greentech company, Bloom Energy, which reached a valuation above $1 billion in 2009.

- The three most active venture capital investors in U.S.-based unicorns, by total number of deals, are: Sequoia Capital, Andreessen Horowitz and Khosla Ventures.